Two things have always been crucial in the assignments we do for our clients: what are the benefits we create (expressed in Economic Value or Cash Value Added) and are they truly excited and delighted by what we do. Over qualified resources, continuous support by peers and validation of the results are key in accomplishing this. But at least as important: are we able to measure and prove it? benefits Management has developed into something of a specialism, especially if you do not only measure in financial or quantitative terms, but also in areas like Risk, Scalability, Agility, Motivation.

Customer satisfaction, or even Client Delight is another challenge. Luckily this topic has been addressed some twenty years ago, by Fred Reichheld, a consultant from Bain & Company. He spent years researching enthusiasm, loyalty and commitment in customer relationships. Surveys did not seem to provide the answers he was looking for, partly because the answers from dissatisfied, undifferentiated and enthusiastic customers were so different that they could not drive any management decisions on improvement.

For answers he focussed on the happy customers only and decided to measure their enthusiasm by asking them one question, that he thought related directly to their loyalty: how willing were they to recommend the firm. We see this unpaid marketing department at work every day, nowadays through recommendations on the internet, and more than anything else, by the Like button of Facebook.

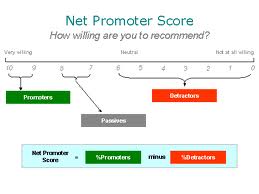

Back then, it was a new concept, which he called Net Promoter Score, or NPS. More than the financial benefits our clients have, and definitely more than the revenue we generate, the level of loyalty created is key to success, and yes it is similarly important to measure the level of frustration and disappointment of those who might become active detractors.

With growth come more formalized processes, more dashboards and reports. close relations and intuition alone is no longer enough to keep track of our performance, and the time has come to also implement this process: Basically all that is required are three steps

Step 1.: ask each and every client one question: “How likely are you to recommend us?”, and have them score the likelihood on an eleven-point scale from 0 to 10

Step 2: Break the results up in three categories: those that gave ratings from 0 to 6 are “Detractors”, the one that logged a 7 or 8 are “passively satisfied”, and only the score of 9 and 10 represent the “Promoters”.

Step 3: Compute the score by only looking at the difference between the Detractors and promoters: %Promoters – %Detractors = %Net Promoters.

So far so good. That is to say: there is potentially a lot wrong with NPS. A 0 score and a 6 have the same impact on the score, but from the client’s perspective there is probably a large difference. Also 0% detractors and 60% promoters gives the same result as 20% detractors and 80% promoters. So we want more: we want to know what are the reasons behind the score, and we want to be able to act on specific cases if there is reason. It is a one-question-only thing some say. If you do not understand the data you cannot act others argue. It seemed so simple

Now, three decisions need to be taken. Do we ask this question only, or do we ask more to find out what drove the score? Do we ask the questions ourselves, or do we get more honest answers if someone else asks them, and do we ask face-to-face, by phone, or by mail/online?

More discussions. We asked for advice. The specialists gave us options. One question, a few questions, many questions. Open questions, closed questions. Damn.

We asked more advice. some of the reactions were outspoken, almost emotional:

On line surveys are no more effective than written… only difference is the envelope.

The problems with written/on-lines include…

- Only outliers are motivated to respond… those who are very happy or very unhappy… so you get skewed results.

- You don’t know who actually responded (the VP’s emo-punk daughter? An Admin? The dog?

- The spontaneity (and any associated honesty) is lost.

Why in the world would anyone follow-up by phone to a written survey?

Respondents should NEVER be “followed-up” on unless they specifically request it.

Even if their responses are negative!

No respondent wants to justify their response or discuss it further… unless they ask for it.

The right way to do it is to be sure you ask enough open-ended questions in the survey to get the info you need without follow-up.

When you follow-up (and especially if you quiz them on any response), you bias or destroy their future cooperation.

Phone is best, 3rd party, brief is good.

Okay, we got the message.

So this is what our survey looks like. Two questions, preceded by an e-mail, asked by phone, by someone the client does not have a personal relation with:

1. Based on the work Qhuba did for you, how likely is it that you would recommend Qhuba, on a scale from 0 tot 10?

2. What factor had the most impact on your answer

- the character and behavior of the resource (like integrity, cooperation)

- the competences of the resource (knowledge, execution power)

- the benefits realised versus the cost

- the cooperation with other people in our firm

- the relation and connection you have with our network

- something else

Now I have one last question: How likely do you think it is that the NPS score we log and the answers to these questions will help us create more value for happier clients?

Posted by Editor

Posted by Editor